2025 will mark a turning point for real estate.

After three complicated years, the recovery is here: sales volumes are picking up, with a 12% increase in 2025, credit conditions are easing, and prices are stabilizing, even rising in some cities.

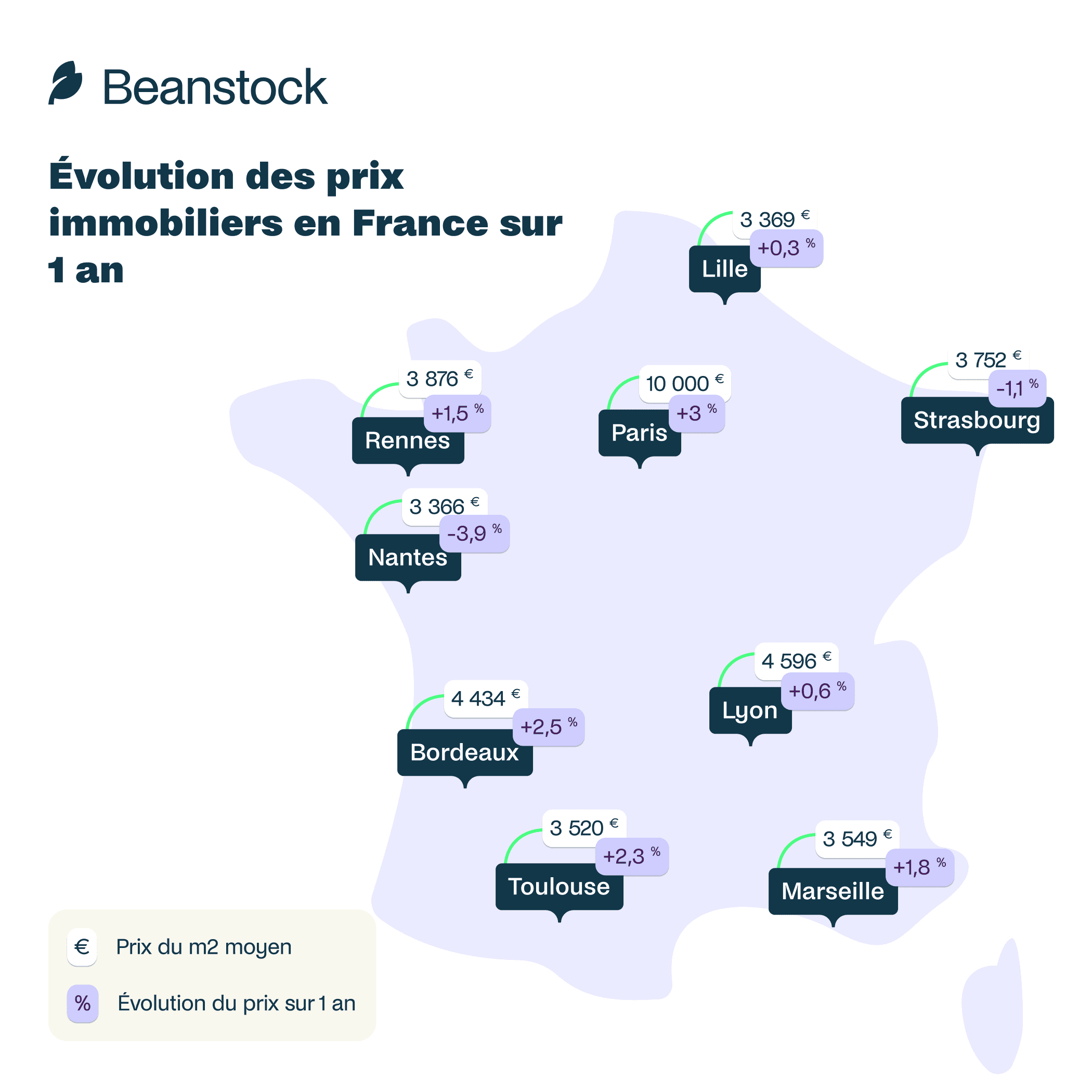

In Paris, prices have increased by 3% year-on-year, crossing the threshold of €10,000/m²!

At the same time, the rules of rental investment are evolving fundamentally: Finance Act 2026, taxation, status of the private landlord, but also new regulatory constraints (DPE, rent controls).

2026 opens a new cycle.

A more selective and technical cycle, offering opportunities for investors who master the new rules of the game. Investing in rental properties has never been so relevant - provided it is done intelligently!

The assessment of real estate prices after 2025

The signals of a gradual recovery in buying

The French real estate market has experienced a turnaround after two years of significant turbulence, and 2025 is marked as a pivotal year according to the barometer. Activity has started to rise again, with nearly 929,000 transactions completed in the last twelve months by the end of October 2025, which represents an annual increase of about 11 % - a strong indicator of renewed interest from buyers. As a reminder, for the past 3 years, the volume of sales had been in constant decline, so this is a very positive signal for the market.

This increase in volumes reflects less of a speculative surge and more of a market rebalancing: buyers, who have long been constrained by high rates and financial uncertainties, are gradually regaining the ability to realize their projects. The combined effect of price adjustments and the stabilization of credit conditions contributes to this return of transactions.

The rise in rents takes hold

Contrary to the hyper-acceleration observed in the previous years, the increase in rents has significantly moderated. Over the year, it has settled around +1.3 %, a much calmer pace than a year ago when it was approaching +3 %. This deceleration is linked to a relative improvement in the buying market: more households that were previously forced to rent are finding the possibility to buy, which slightly reduces rental pressure.

However, this moderation does not mean that tensions have disappeared: in tight areas - particularly large urban areas - the rental supply remains very limited, which maintains upward pressure on rents despite the slowdown. This allows the rental real estate market to recover, notably with gross yields higher than the average of the last 5 years.

The significant gap between the rental market and the sales market

A key point of the 2025 assessment is the persistent divergence between the dynamics of the rental market and the sales market. While sales transactions show signs of acceleration, the rental market continues to display enduring tension, especially in urban areas where the scarcity of supply persists. This situation is symptomatic of a still fragmented market: real estate buyers and rental property investors can now become active in the buying segment, but the structural constraints of the rental housing limit the adjustment of prices and rents.

In very tight areas, this divergence results in a complex trade-off for households: remain a tenant in a context of rising rents or try to secure a purchase in a more stable but still demanding financial environment. In other words, rental real estate investment was the primary reason to invest in housing, while now more buyers are accessing ownership with the goal of buying their primary residence.

The return of buyers after two years of inactivity

One of the most significant lessons from the barometer is the actual return of buyers to the market. After two years where activity was paralyzed by high credit rates, persistent inflation, and economic uncertainties, the increase in transactions reflects heightened confidence - even if it remains cautious.

This recovery is not uniform: it depends on the profile of buyers and geographical zones. In major metropolitan areas, price increases remain moderate with ranges generally between +1 % and +3 %, with certain markets like Paris being slightly more dynamic.

Conversely, some cities show an still fragile dynamic, even a decrease in prices, but always less pronounced than before. This diversity highlights that the market is regaining activity, without immediately returning to the levels of frenetic growth observed before the crisis periods.

To help you see clearly, our CEO, Alexandre Fitussi, is organizing an exclusive webinar dedicated to rental investment in 2026:

What does the 2026 Finance Law actually change for investors?

Which cities to prioritize in the new market context?

How to turn regulatory constraints into opportunities?

What types of properties to target in 2026?

Common mistakes to avoid after a market correction phase

The gradual stabilization of financing conditions

The normalization of mortgage interest rates

After the brutal shock of 2022–2024, the year 2025 marked a clear break in the dynamics of mortgage interest rates. According to the barometer, the period of rapid and unpredictable increases is now behind us: the rates have stabilized at a level that is indeed higher than pre-crisis, but has become readable and predictable. This normalization is a key factor in the recovery observed in the purchasing market.

The regained visibility plays a decisive role in real estate decisions. Households can once again project financing over 20 or 25 years without fearing a permanent challenge to their borrowing capacity. This stability, more than the absolute level of rates, explains in large part the gradual return of buyers to the market in 2025, a prelude to the evolution of real estate prices in France in 2026. It should be noted, however, that last year notary fees increased by 0.5%, which is concerning for first-time buyers.

Real estate purchasing power under price constraints

While financing conditions have improved, real estate purchasing power remains structurally constrained. The barometer highlights that the decrease in prices observed between 2022 and 2024 did not fully compensate for the rise in rates. Consequently, many households still need to adjust their ambitions, whether in terms of surface area, location, or type of property.

This context creates a more rational market: buyers are making more comparisons and favoring properties that are correctly priced. Overpriced properties or those requiring significant renovations experience longer selling times, while “well-placed” properties continue to find buyers quickly. This selectivity directly influences the evolution of real estate prices in France in 2026, favoring moderate increases rather than a generalized rebound.

The banking filtering that favors solid applications

The stabilization of credit does not come with a relaxation of banking requirements. The barometer highlights a lasting phenomenon: lending institutions continue to favor the most secure profiles. Personal contribution, professional stability, and sound financial management remain determining criteria for accessing credit.

This filtering helps to sanitize the market. Purchases are increasingly based on solid projects rather than on expectations of quick capital gains. This evolution limits the risks of overheating while supporting a base of qualitative demand, capable of gradually absorbing the available supply. On a national scale, this logic strengthens the idea of a new equilibrium of real estate prices in France in 2026, based on actual solvency rather than on maximum leverage.

Political instability as a factor of real estate tension

The confidence of households and investors, a decisive variable

The evolution of real estate prices in France in 2026 will depend as much on economic fundamentals as on a more intangible but determining factor: confidence. The barometer highlights that the observed recovery remains fragile, as it is largely conditioned by the ability of households and investors to project themselves into the long term. However, political and budgetary instability weighs directly on this projection.

When the political climate becomes uncertain, real estate decisions are often delayed. Purchasing a home or an investment property commits for several decades; any questioning of tax, social, or heritage rules reinforces hesitation. This caution does not necessarily lead to a fall in prices, but it limits their ability to accelerate significantly, contributing to a scenario of slow and heterogeneous progression.

The country risk and its transmission to real estate rates

One of the major lessons from recent months lies in the close link between political instability and financial conditions. The barometer reminds us that the perception of country risk directly influences the state's financing cost, then that of banks, and ultimately mortgage rates. A deterioration of this perception mechanically results in upward pressure on rates, even in the absence of strong inflationary tensions.

In this context, the evolution of real estate prices in France in 2026 remains closely correlated to the country's ability to reassure the markets. Political stabilization would consolidate current rates and support demand. Conversely, a resurgence of tensions could slow the recovery by increasing the cost of credit, without causing a collapse, given the persistent scarcity of supply.

Asset allocation in times of uncertainty

Faced with an uncertain political environment, wealthier households and investors are making more sophisticated asset allocations. The barometer highlights a gradual reallocation of investments, where real estate regains a central but selective place. Capital is primarily directed towards assets deemed resilient: well-located properties, tight zones, deep rental markets.

This allocation is not motivated by the search for quick capital gains, but by the desire to preserve capital within a tangible framework. This logic supports prices in certain segments while leaving others out. Thus, the evolution of real estate prices in France in 2026 is less in a uniform national dynamic than in a multiplication of micro-markets with distinct trajectories.