Choosing between the LMNP status or LMP is a major decision for investors in furnished rental. The two regimes offer different tax advantages, but they cater to specific profiles and objectives. Discover the differences between the two regimes, but more importantly, which one is most appropriate for you.

The status LMP (Professional furnished landlord)

As its name indicates, the status LMP is aimed at landlords for whom furnished rental is a main activity or an important source of income, thus they are considered professionals.

The LMP regime imposes higher income conditions but also offers tax advantages that can be interesting for certain investors.

Characteristics of LMP

Income Conditions : To qualify for the status of LMP, your rental income from furnished property must exceed €23,000 per year and represent more than 50% of your household's taxable income.

Taxation on Professional Profits : In LMP, rental income is taxed in the category of industrial and commercial profits (BIC) and benefits from deductions similar to LMNP, such as expenses and depreciation.

Benefits in Case of Capital Gains : Capital gains realized in LMP can be partially or fully exempt if you hold the property for more than five years, depending on the annual income conditions.

Contributions to Social Charges : Unlike LMNP, LMP requires investors to contribute to social charges, but this allows for access to social coverage (health and pension insurance).

The LMNP status

The LMNP status is aimed at investors who do not make furnished rentals their main activity. In other words, if the furnished investment is simply a means of creating wealth or an additional income, then this scheme applies to you.

Nevertheless, by choosing the LMNP scheme, you benefit from advantageous taxation while maintaining the status of an individual.

Characteristics of the LMNP

Limited Income : To remain within the LMNP framework, your rental income from furnished properties must be less than €23,000 per year or represent less than 50% of the household's taxable income.

Attractive Tax Regime : The LMNP allows you to choose between the micro-BIC regime (with a flat-rate deduction of 50%) and the actual regime, which offers the possibility to deduct charges and amortize the property, thereby reducing taxation.

Exemption from Social Charges : LMNP income is subject to social contributions (CSG and CRDS) but does not require contributions to professional social charges, which reduces taxation.

Comparison LMNP and LMP

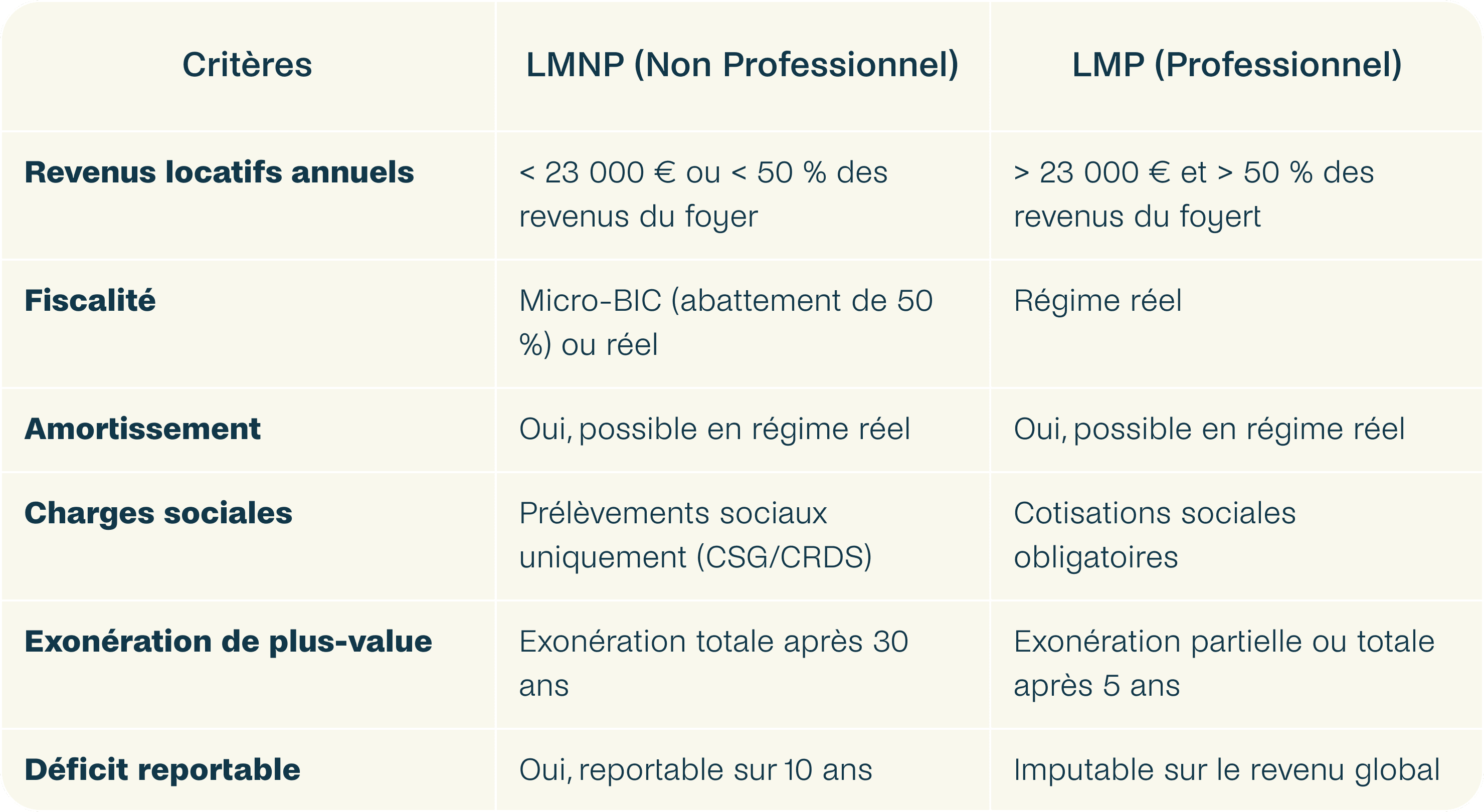

Choosing between LMNP or LMP depends on several factors, such as your income, your investor profile, and your tax objectives. Here is a comparative table to better understand the differences.

LMNP or LMP: which status to choose?

Advantages of LMNP

The LMNP status is ideal for individuals wishing to generate rental income without turning this activity into a main activity. Its main advantages are:

Simplified taxation with the micro-BIC regime or the deduction of depreciation under the actual regime.

Flexibility and absence of professional social contributions.

Simplified management without the administrative formalities imposed on the LMP status.

Advantages of LMP

The LMP status is more suitable for investors for whom furnished rental represents a major activity or a substantial additional income. Its strengths include:

Partial or total exemption from capital gains after five years of ownership.

Ability to offset the deficit against overall income, reducing overall tax.

Social contributions providing social coverage (health insurance and retirement).

LMNP or LMP: Which solution is right for you?

The choice between LMNP or LMP will depend on your financial goals and tax situation. If you are a private investor and your rental income is modest, the LMNP status will provide you with optimized profitability without social charges. On the other hand, for investors with significant rental income, the LMP could be more advantageous to take advantage of capital gains exemptions and deductions on overall income.

Don't wait any longer and get support when choosing your status and your tax declaration with Beanstock's accounting expertise service.

Also discover